| 51st Annual General Meeting |

| October 2016 |

| |

Distinguished Members of PSMA

It is a pleasure to present the Annual Review of Pakistan Sugar Mills Association for the year ending 30th September, 2016. The Annual General Meeting is being held at the conclusion of term of the Chairman and Central Executive Committee. The names of newly elected members of Central Executive Committee will be announced at the end of the meeting. I will now refer to the various events that the sugar industry experienced during the preceding year |

| |

Review 2015-16 |

| In the year 2015-16, as per figures provided by the crop reporting department of the Provincial Governments, sugarcane was planted over an area of 1.131 mln hectares with a production of 65.451 mln tonnes. The increase in area of sugarcane plantation was due to non-attractive prices received by the growers from other competing crops like Rice and Cotton as sugarcane being a cash crop has proved to be more beneficial to the farmers. The high production of sugarcane resulted in sugar production of more than five mln tonnes as forecasted in 2014-15. The carry forward stock in 2014-15 was 1.344 mln tonnes. This took the total availability to 6.459 mln tonnes against the domestic requirement of 4.9 mln tonnes leaving a surplus of about 1.56 mln tonnes over the domestic requirement. |

| |

PRODUCTION 2015-16 |

| |

| |

"000" hect./tonnes |

| Sugarcane plantation |

= |

11,31 |

| Sugarcane produced |

= |

65,451 |

| Sugarcane Crushed |

= |

50,043 |

| Utilization by mills |

= |

76.45% |

| Sugar produced from cane |

= |

5,082 |

| Sugar produced from beet |

= |

0.033 |

| Sugar refined from raw |

= |

- - - - |

| |

|

|

| Total Sugar Produced |

= |

5,115 |

| Carryover stocks (Mills & TCP) |

= |

1,344 |

| Sugar availability for 2015-2016 |

= |

6,459 |

| Export(Source: MOIP) |

= |

0.294 |

| Domestic consumption 2015-16 @ 24 kg/capita |

= |

4,900 |

| Carry forward for 2016-17 |

= |

1,265 |

|

| |

Sugar Export |

| Government of Pakistan allowed in December 2015 a quantity of 500,000 tonnes of sugar for export until March 31, 2016. Since international sugar prices remained low and the export parity was around Rs. 45-47 per kg, thus export was not feasible due to high cost of sugar production and low price at domestic and international market without the Government support in shape of some incentive. In addition the Government fixed the sugarcane indicative price at Rs 180/40 kg in Punjab and KPK and Rs 182/40 kg in Sindh for the year under review being the reason for the escalated cost of sugar production over and above the international market. Some of these facts were placed before the Government and a series of letters for allowing incentive, PSMA was able to convince the Government and a cash support for incidental and freight @ Rs. 13 per kg was allowed. It was further decided by the ECC of the Cabinet that this cash support would be shared equally by the Federal Government and the respective Provincial Governments. Export to Afghanistan and Central Asian Republic was also allowed by land routes in dollars terms with minimum price of US $ 450/MT. The State Bank of Pakistan started receiving application for quota allocation on first come first serve basis; however, some of the mills could not utilize the quota in the given time. However a quantity of 0.294 mln tonnes was exported. In order to discourage import of sugar from the global market, efforts were made for imposition of regulatory duty (R.D) on import of sugar to protect interests of the farmers. |

| |

| Procurement of sugar by TCP |

To improve the stock position in the country and to meet unforeseen domestic demand, PSMA has already proposed in their previous meeting of Sugar Advisory Board to maintain a strategic buffer stock to keep its supply line active for the public sector outlets. Unfortunately, the proposal was not agreed by the Government based on some technical reasons. By the end of August, 2016, TCP had 2,291 MT of sugar in stock. |

| |

Sugarcane price |

The continuous increase in the minimum indicative price of sugarcane and resultant increase in area under cultivation of sugarcane puts pressure on price of sugar in domestic and international market. PSMA has been pushing for a uniform sugarcane price policy in line with the cost of sugar production or to link the sugarcane price with the quality of cane. PSMA has argued consistently that linking price with the quality of cane would benefit both the mills and the growers.

The growers who plant quality cane varieties and do more efforts for a better yield and recovery would get more prices compared to inefficient crop harvest. The matter is being discussed in various meetings and the PSMA stance has been highlighted. The indicative prices remained unchanged at Rs. 180/40 kg in Punjab and Khyber Pakhtunkhwa and at Rs. 182/40 kg in Sindh as against low price of sugar. The price fixed in Sindh remained sub judice. For 2016-17, the Provincial Governments are yet to announce the sugarcane indicative price. |

| |

Outlook 2016-17 |

The Provincial Governments in their second estimate for 2016-17 have indicated crop area under sugarcane at 1.225 mln hectares compared to 1.131mln hectares of the preceding year. Sugarcane production for 2016-17 is forecasted at 71.371 mln tonnes compared to 65.451 mln tonnes of the previous year. The increase in area has been reported in Punjab and Sindh over the corresponding period of last year by about 12 % in Punjab and by almost 2.5 % in Sindh. Similarly the production in Punjab has increased by 14 % compared to last year and 17% over 2014-15. In Sindh the increase in production over 2014-15 remained at almost 9.0%. These figures indicate an upward trend in the production of sugarcane and if the crop condition remains favorable then we may expect a sugar production of about 5.5 mln tonnes in the year to come with carry forward stock of 1.265 mln tonnes by the end of the sugar year.

Note: (sugarcane production work out on average yield for last three year) |

| |

Global outlook 2016-17 |

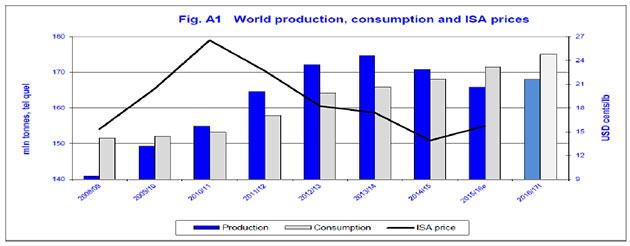

The ISO in its report for August 2016 has reported world production for 2016/17 at 168.010 mln tonnes versus 165.840 mln tonnes of the previous year. Similarly the consumption for 2016-17 is estimated at 175.058 mln tonnes versus 171.584 mln tonnes of last year thus creating a deficit of 7.048 mln tonnes in production and upward trend of 2.02% in consumption. The first forecast of the World balance sheet from October 2016 to September 2017 puts world production lower than the world consumption mainly due to higher projected world consumption, import demand exceed export availability and reduced ending stock. The import demand has been worked out at 56.695 mln tonnes versus 58.362 mln tonnes of last year and export availability of 56.610 mln tonnes versus 58.501 mln tonnes in the previous year. It is further added that from 2010-11 to 2015-16, the world production surpassed the consumption but could not maintain the upward trend in 2015-16 and may continue its deficit trend in 2016-17.

Sugar production in 2016-17 in the Indian Subcontinent is expected to decrease to 30.116 mln tonnes, down 1.0 mln tonnes or 3.2% from the previous season.

In India, at the beginning of July, the Indian Sugar Mills Association (ISMA) released its first forecast for the 2016/17 season to start in October. Output is expected to decrease to 23.26 mln tonnes, compared to 25.1 mln tonnes in the current season. The total area under sugarcane is estimated at around 4.99 mln ha, down 5.5% from 2015/16. With stocks on October 1st at 7.1 mln tonnes, total sugar availability during the next season is put at 30.4 mln tonnes more which is enough to meet the domestic sugar consumption requirement of 26 mln tonnes. ISO forecast India sugar production at 24.5 mln tonnes 4% down from 2015-16. While in Pakistan in 2016-17 ISO expect sugar production to stabilize.

In India, the world's largest consumer, domestic sugar prices rallied in recent months as a response to a sharp fall in 2015/16 domestic output and expectations of even smaller harvest in the coming season to start in October. At the end of July, prices reached a multi-year high of INR 38,474/tonne (NCDEX, Sugar M2000, front month), a jump of nearly 55% since the start of the season. Concerned with soaring prices, in May the Government imposed limits on the quantity of the sweetener that traders and large users such as confectioners and soft drink makers can stock. One month later in a bid to keep the domestic prices of sugar under check, the central government imposed a 20% duty on the export sugar. |

| |

| Table-1 |

World Sugar Balance

(mln tonnes, telquel) |

| |

2016/17 |

2015/16 |

Change

In mln tonnes in % |

| Production |

168.010 |

170.911 |

2.170 |

1.31 |

| Consumption |

175.058 |

173.398 |

3.474 |

2.02 |

| Surplus/Deficit |

-7.048 |

-2.487 |

|

| Import Demand |

56.695 |

56.450 |

-1.667 |

-2.86 |

| Export Availability |

56.610 |

56.549 |

-1.891 |

-3.23 |

| End Stock |

75.598 |

83.352 |

-6.963 |

-8.43 |

| Stock/Consumption ratio in % |

43.18 |

48.07 |

|

|

Export and import figures may not match due to rounding and time lags between exports and imports

Source: ISO Quarterly Market outlook Aug 2016 |

| |

|

| |

International Sugar prices |

Sugar prices show continuous downfall trend during the year under review. The sugar year 2014-15 started with the price of sugar in international market at around $ 429/tonne which continued to fall constantly during the year and reached at the lowest level of $ 341/tonne in August and went upward to $ 349/tonne in September 2015 (ISO white sugar price index)with the decrease of around 19% (Table 2). This created an unbalanced situation for our industry during the year under review due to surplus sugar stock. |

| |

| Table-2 |

| ISO Monthly Average Prices of Refined Sugar |

|

|

|

|

|

|

US $/Ton |

| Months |

2008-09 |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| October |

337.08 |

592.38 |

682.97 |

676.87 |

557.85 |

499.90 |

428.59 |

388.48 |

| November |

330.67 |

596.70 |

719.41 |

635.55 |

521.88 |

471.25 |

420.59 |

400.87 |

| December |

319.58 |

648.25 |

747.52 |

604.92 |

518.54 |

449.61 |

397.97 |

409.23 |

| January |

347.70 |

729.90 |

770.36 |

620.66 |

505.36 |

424.34 |

397.80 |

415.73 |

| February |

388.35 |

705.84 |

746.21 |

634.83 |

499.06 |

454.76 |

384.33 |

388.39 |

| March |

392.24 |

529.62 |

701.88 |

638.24 |

518.01 |

471.84 |

364.95 |

436.29 |

| April |

405.16 |

479.21 |

655.56 |

601.56 |

500.88 |

468.19 |

367.38 |

438.45 |

| May |

444.87 |

453.94 |

599.94 |

555.14 |

482.20 |

478.00 |

365.28 |

474.05 |

| June |

445.45 |

482.59 |

688.47 |

571.02 |

483.03 |

476.27 |

352.15 |

527.53 |

| July |

468.42 |

542.17 |

769.50 |

621.14 |

477.42 |

458.03 |

358.72 |

541.33 |

| August |

556.93 |

534.13 |

736.20 |

568.77 |

484.63 |

437.52 |

341.01 |

538.80 |

| September |

576.71 |

601.31 |

694.41 |

560.65 |

485.20 |

421.61 |

348.83 |

570.70 |

| Avg. Price |

417.76 |

574.67 |

709.37 |

607.45 |

502.84 |

459.28 |

377.30 |

460.82 |

|

Source: Monthly Market Reports ISO |

| |

| International Sugar prices |

| International sugar prices showed nominal upward trend during the year under review. The sugar year 2015-16 started with the price of sugar in international market at around $ 388/tonnes, this continued to increase constantly till September 2016 to $ 570.70/tonne. |

| |

Highlights |

The global sugar surpluses ended in 2015/16. Global deficit is projected at 7.048mln tonnes for 2016-17 and world output shows upturn of 2.17mln tonnes. World consumption is to grow by 2.02% or 3.47mln tonnes. The start of 2016-17 is faced with world production of 168.010mln tonnes as per ISO first full assessment with lower output projected for India, Brazil, Argentina Australia and higher consumption anticipated in Thailand, India, Australia and Pakistan. World consumption for the upcoming year has been forecast at 175.058 mln tonnes (2.02% growth) thus creating a statistical deficit of 7.048 mln tonnes versus world production of 168.010mln tonnes. The export availability is short by about 3.23% lower than the import demand. Similarly as indicated above, the international prices have improved showing an impact of the current deficit under review. The sugar prices in the local market have also improved closing to match the cost of production. For upcoming year the sugarcane crop area reported by Provinces shows an upward trend of about 9% over the previous year with crop output of about 71 mln tonnes. This may lead to sugar production of more than five mln tonnes over and above the domestic consumption. Therefore consistent efforts would be required to offload the surplus and to create a favorable environment for the stake holders, the sugar industry and the growers. However, it has also been opined in the government circles to deregulate the sugarcane price in-order to create a market based environment and get rid of the subsidies regime. |

| |

| Power cogeneration: |

Under the 2002 policy for IPP, incentives were announced for power cogeneration units including sugar mills. Sugar mills in Pakistan have been producing surplus bagasse, a renewable fuel as by-product in the sugar manufacturing process. The power so produced could not be exported to grid due to low pressure 23 bar based power system. To be able to generate surplus power, sugar mills have to switch to a high pressure boilers and turbines. The amount of bagasse currently produced by sugar mills has the potential to generate between 2000 to 3000 MW depending on plant per day crushing capacity. By now four projects have achieved commercial operation and are supplying 145.10 MW to the national grid. Sugar mills are keen to help the energy sector of the country; however, they are faced with some problems like grid interconnection study, Power Acquisition request, Generation License and award of upfront tariff with serious deviation from the timelines indicated in LOI/framework. We appreciate the efforts of the AEDB and other relevant Deptt encouraging sugar mills to produce power for export to national grid. The Annual General Meeting of Pakistan Sugar Mills Association provides a platform to discuss and review different aspects of development over the past years, appraise performance and develop a uniformed opinion on a policy useful for the future growth. To streamline the Association’s efforts in prioritizing its short and long term objectives, efforts are also being made to provide services to the member mills in the shape of feedback on local and global sugar situation and to create a climate favorable for more planned expansion in sugar producing capacity and enhance productivity through its theme of vertical expansion. PSMA has been promoting a process of consultation and seeking guidelines/ideas from Association’s constituents to further improve its performance.

In the end I would like to register my thanks to the Central and Zonal executive committees, all members of PSMA, and the Secretaries PSMA for their cooperation, assistance and support. At the same time I welcome the new Chairman and wish the new management a success and assure them of my full support and cooperation and would be available for guidance if need be to meet the future challenges faced by the sugar industry. |

| |

| |

Thank You |

|

| Oct, 20 2016 |

|

Iskander M. Khan

(Chairman) |

|