|

|

|

|

|

|

|

|

| 48th Annual General Meeting |

| September 2013 |

| |

Distinguished Members,

It is an honor and pleasure for me to welcome you here at the boat club Karachi at the 48th Annual General Meeting of Pakistan Sugar Mills Association and to present the annual review for the year 2012-13. This year sugar industry was

faced with many problems such as disposal of surplus sugar stock, lower ex-mill

price coupled with higher indicative price of sugarcane fixed by the Provincial

Governments. The sugar mills commenced the crushing season 2012-13 as

another surplus sugar year in the wake of higher global supply and lower sugar

prices. However, with the consistent efforts of the PSMA we were able to overcome

most of these issues.

Now I am pleased to present the annual review for the year 2012-13. |

| |

PRODUCTION 2012-13

The Year under Review |

| |

In the year 2012-13 the crop reporting Departments of the Provinces have

reported crop area of Sugarcane at 1.128 mln hectares with 63.718 mln tonnes

production. The higher production was due to favorable climatic conditions and high

prices received by the growers in the previous year. The sugar production from

above crop by the close of the crushing season was reported to be 5.030 mln

tonnes almost at par with our estimates of five mln tonnes in our previous annual report and above the domestic needs of 4.4 mln tonnes.

Sugar Position 2012-13: |

| |

| |

|

"000" hect./tonnes |

| Sugarcane plantation |

= |

1,128 |

| Sugarcane produced |

= |

63,718 |

Sugarcane Crushed

(With 81% utilization) |

= |

50,089 |

| Sugar produced from cane |

= |

5,030 |

| Sugar produced from beet |

= |

0.033 |

| Sugar refined from raw |

= |

- - - - - - - - - |

| |

|

|

| Total Sugar Produced |

= |

5,063 |

| Carryover stocks (Mills & TCP) |

= |

1,394 |

| Total Availability for 2012-13 |

= |

6,457 |

|

| |

The higher production of sugar reported in 2012-13 and carryover

stock of the previous year created a glut-like situation, which kept the ex-mill

sugar prices at very depressed levels and could not move out of its lowest ebb

during the year of review. The prime and foremost responsibility, which PSMA carried out, was to make arrangements for disposal of surplus sugar. |

| |

Sugar Export

PSMA has been consistently following and held several meetings with the Ministry

of Industries (MOI), Ministry of Commerce (MOC), Finance, FBR, Sugar Advisory

Board and pleaded its case in the light of actual on ground position for the timely out

flow of leftover sugar stock. As a consequence of our consistent efforts to arrest the

lower trend in the ex-mill price and to enable the sugar mills to pay off the Grower's

dues, the Government has allowed exports of 0.9 mln tonnes in the year under

review in addition to 0.3 mln tonnes allowed in sugar year 2011-12. |

| |

| Decisions |

Tonnes |

| 31-01-2012 |

100,000 |

| 15-05-2012 |

200,000 |

| 03-10-2012 |

200,000 |

| 23-11-2012 |

200,000 |

| 11-12-2012 |

500,000 |

|

| |

The first trench of 0.1 mln tonnes was allowed through allocation of quota of

5000 tonnes, 0.2 mln tonnes capping the quota at 10,000 tonnes and a committee

was constituted under special secretary to Prime Minister to negotiate and

encourage the sugar mills to utilize the approved quota. Later due to slow phase of

export the quota system was abolished and allowed export on first cum first serve

basis with timeframe of ninety days. But the export was still at slow phase. The

major impediment in the export was the lower trend in the international prices and

higher cost of production of the Pakistan Sugar due to high cost of raw material. |

| |

To address this problem and put sugar export on fast track basis the issue was again taken up with Ministry of Commerce (MOC), Finance and FBR. Resultantly

the relevant Ministries were convinced with facts provided by PSMA and thus

allowed through ECC inland freight subsidy of RS 1.75/kg of sugar to be exported

across the board on January 10, 2013.

The Major problem faced by the sugar industry was payment to the growers. PSMA appreciated the incentive of freight subsidy provided by the Government,

however, due to un-competitiveness in the international market it alone could not

help to enable the sugar mills to export on fast track basis. Therefore with the same

efforts and to resolve the issue the matter was again taken up with the Government

in view of the liquidity problem faced by the mills. The ECC th en allowed a reduction in the rate of Federal Excise Duty (FED) for sugar mills as an incentive for export of

sugar on January 10, 2013.

With these incentives in hand the sugar mills were able to export 11.45 mln tonnes (as reported by statistic dept) of sugar out of the total approved quantity of

1.2 mln tonnes till last week of August 2013. The modus-apprendi adopted for the

export of sugar was first come first serve basis through registration of contract with

State Bank of Pakistan with time frame of 90 days. The main reason behind slow

phase in physical export was that some exporter have obtained the quota but did

not physically ship in the allocated 90 days time, rather the quota was to be

renewed at the close of the dead line. PSMA took up this matter with MOC and

MOIP that time period for the allocation of quota shall be reduced to 60 days and

shall be allocated to other party after the expiry of the given time. The Government

did reduce the timing; however, it could not be implemented by the SBP due to

technical reasons. The sugarcane crop for 2013-14 is expected to be higher than

2012-13, its crushing is approaching fast. The sugar mills were still carrying a

surplus of more than a mln tonnes in their inventories. The expected production

from 2013-14 crop is estimated to be on higher side too which may further expand

the volume of the carry over surplus from 2012-13.

PSMA has been consistently following the permission for more export before

the start of next crushing season in order to cope with the incoming crop situation

and to ensure payment to the growers. PSMA therefore sought an audition with the

Finance Minister on Aug 28, 2013 explaining the current stock position and the

upcoming higher production of sugarcane crop. Later on Sep 4, 2013 Sugar

Advisory board (SAB) meeting was called where the sugar situation was reviewed

in the presences of representative of the, Finance, Commerce, Industries, Food

Security, FBR SBP, Provincial Government and the growers. After detailed

deliberation on the various issues confronting the industries and growers the SAB

recommended in their meeting that the Government shall allow a further export of

0.5 mln tonnes in such a way that 0.1 mln tonnes may be exported every month

starting October 2013. It was also recommended by SAB that TCP to purchase 0.2

mln tonnes from the domestic mills to strengthen their stock for supply to different

public sector out lets.

In the light of the SAB recommendation and personal hearing by the ECC to

the sugar mills delegates headed by its Central Chairman on 07 -9-2013, the ECC

allowed the sugar mills to export a total of 500,000 MT of sugar out of which

250,000 tonnes was allowed to be exported with immediate effect up to 31st

October, 2013; and the rest 250,000 tonnes from 1st

November, 2013 onward on

first come served basis. SBP to facilitate export of sugar through registration of

contract, however, the time frame for shipment would be 45 days instead of 90

days. In return Mills to clear the outstanding arrears of Rs. 1.7 billion to be paid to the growers and to start crushing sugarcane in Sindh and Punjab by 1st

November

and 15th

November 2013, respectively.

The above export was decided to be against irrevocable letter of credit or a

contract with 25% non-refundable advance payment to be forfeited in favour of

Government of Pakistan in case of non-performance. To encourage the mills for

export inland subsidy @ Rs. 1/- kg instead of the entire quantity of 500,000 MT of

sugar was also agreed.

Procurement of sugar by TCP

To improve the liquidity of the sugar mills PSMA has been working hard with Government on the purchase of sugar from the domestic mills to keep their strategic stock at the approved level and play its role in case of any unforeseen situation as well as to keep its supply line on for the public sector outlet. In line with our request TCP tendered the following quantity during the year under review.

The first tender was floated for 0.327 mln tonnes on 14-12-2012, second on 3-7-2013 for 50,000 tonnes and third for 49992 tonnes on 18-7-2013. On Sep 7, 2013 the ECC further allowed purchase of 0.1 mln tonnes to be tendered in two slots of

50,000 tonnes each in 30-40 days in-order to improve liquidity of mills and to build

up their strategic stock at appropriate level. This is in addition to the tenders floated

in 2011-12 i.e on 15-11-2011, 23-1-2012 and 21-5-2012 for 0.378 mln tonnes, 0.1

mln tonnes and 0.2 mln tonnes. With this arrangement the availability of sugar in the

market remained at comfortable level of the consumers and mills have been able to pay off the growers. |

| |

Prospects

2013-14

|

On country basis the estimated area of sugarcane during the crop cycle 2013-14 is to be reported to be around 1.13 mln hectares compared to 1.111 mln hectares during preceding crop cycle, i.e., 2012-13. It is estimated that sugar production from an area of 1.13 mln hectares would give an approximate production of 64 mln tonnes of sugarcane based on 56.4 tonnes per hectare yield. The sugar production forecast by utilizing 80-85% of sugarcane production with a projected recovery of 9.9% is likely to be five mln tonnes plus.

The consumption for 2013-14 for a population of 184.35 mln at 24.6 kg per

capita (world average) is likely to be 4.5 mln tonnes. PSMA has been making all out efforts to off load the excess stocks. |

| |

Sugarcane price

The Provincial Government every year fixes indicative price of sugarcane before the start of the crushing season. For 2012-13 the sugarcane price was fixed at Rs 170/40kgs for Punjab and KPK and Rs 172/40kgs for Sindh up by 36% over the 2010-11 when the average sugar price was Rs 73.65kg. Now in 2011-12 the retail sugar price dropped to RS 57.16/kg and in 2012 -13 to Rs 53.08/kg. The backward calculation of ex-mill price even does not match the price announced by the Government. Therefore I suggest the Zonal chairman to take up this issue in the sugarcane control board meeting for the upcoming sugar crop. |

| |

| WORLD SUGAR SCENARIO |

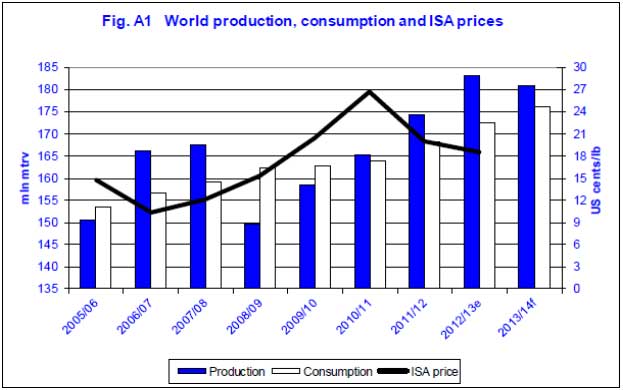

| World Sugar Market

The first assessment of the world sugar balance sheet for the up coming year 2013/14 crop cycle indicates a three years of statistical surplus, estimated at 1.321 mln tonnes in 2010/11, 6.165 mln tonnes in 2011/12 and 10.261 mln tonnes in 2012/13, the world sugar economy is facing another surplus season. The first forecast of the world sugar balance for the period from October 2013 to September 2014 puts world production at 180.837 mln tonnes, raw value. For the first time since 2008/09, in the new season world sugar output is expected to reduce. Whilst output is projected to fall by 2.119 mln tonnes, it will still be the second largest in history. World consumption is projected to grow by a healthy 2.11%, generally in line with the 10-year average of 2.34%. Global use of sugar is expected to reach 176.335 mln tonnes, raw value. As a result, a world statistical surplus of 4.502 mln tonnes is projected (ISO) (Table-1 & bar graph). |

| |

| Summary of the first assessment of the world sugar balance in 2013/14 is provided in the table below. |

| Table-1 |

| World Sugar Balance |

| (mln tonnes, raw value) |

| |

2013/14 |

2012/13 |

Change |

| in mln t |

in %age |

| Production |

180.837 |

182.956 |

-2.119 |

-1.16 |

| Consumption |

176.335 |

172.695 |

3.640 |

2.11 |

| Surplus / Deficit |

4.502 |

10.261 |

|

|

| Import Demand |

52.694 |

54.014 |

-1.320 |

-2.44 |

| Export Availability |

57.054 |

55.739 |

1.315 |

2.36 |

| End Stocks |

74.373 |

74.041 |

0.332 |

0.45 |

| Stocks / Consumption ration in % |

42.18 |

42.87 |

|

|

| Source: ISO Quarterly Market outlook Aug 2013 |

|

|

|

|

|

| |

|

| |

| Highlights |

In 2013-14 sugar year although the world production is expected to shrink by

2.119 mln tonnes but despite this projected fall, the world total supply, at 180.837

mln tonnes, raw value, is still to be the second largest in history. The expected

shortfall is partly mitigated by further gains in Brazil (+0.8 mln tonnes) and Thailand

(+0.691 mln tonnes). Production levels in these leading exporting countries are

expected to reach new records. Record high production is also anticipated for a

number of smaller producers including Ecuador, Ethiopia, Indonesia, Mozambique, Nicaragua, Pakistan, Sudan, Swaziland and Zambia (ISO).

International Sugar prices

Commodity prices have had mixed dynamics during the course of the year Table-3.

Soft commodity prices like sugar has shown down ward trend. Raw sugar prices hit a three year low in July 2013. (Source: IMF/ISO). |

| |

| Table-2 |

| ISA Daily Raw Sugar Price - July 2009 to July 2013 |

| |

|

|

|

|

cents / lb |

| |

2009 |

2010 |

2011 |

2012 |

2013 |

| Jan |

- |

26.47 |

29.61 |

23.56 |

18.89 |

| Feb |

- |

26.24 |

29.47 |

23.2 |

18.28 |

| Mar |

- |

18.66 |

26.24 |

24.12 |

18.46 |

| Apr |

- |

16.45 |

24.36 |

22.75 |

17.8 |

| May |

- |

15.2 |

21.95 |

20.81 |

17.62 |

| Jun |

- |

15.88 |

25.21 |

20.47 |

17.09 |

| Jul |

18.43 |

17.43 |

28.22 |

22.88 |

16.84 |

| Aug |

22.08 |

18.04 |

27.75 |

21.3 |

- |

| Sep |

23.02 |

22.51 |

26.66 |

19.99 |

- |

| Oct |

22.64 |

24.39 |

25.45 |

2031 |

- |

| Nov |

22.64 |

26.35 |

25.1 |

19.34 |

- |

| Dec |

23.53 |

27.98 |

23.04 |

19.31 |

- |

|

| |

| At the end I would like to thank the zonal Chairmen, Central and

Zonal executive committees, all members of PSMA, and the Secretaries PSMA for

their continued cooperation and in time support during these recent crises of the

disposal of surplus stock the Association has been through. I shall be looking

forward for their valuable views, guidance and support so that the industry moves forward together to meet the future challenges. |

| |

|

| |

| |

Thank You |

|

| 24th Sep, 2013 |

|

Shunaid Qureshi

(Chairman) |

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|